Definition #

Equivalent names #

- General insurance can be broadly defined as anything that is not life insurance.

- Several names:

- General Insurance (GI) - traditionally in Australia

- Non-life insurance - traditionally in Europe

- Property and Casualty Insurance (P&C) - traditionally in North America

- There is political push within the ASTIN section of the IAA for generalising the term of “General Insurance,” but this is ongoing

Two main types #

- Property insurance covers the loss arising from damage to property such as buildings, contents, motor vehicles, aircraft and cargo

- Liability insurance - Liability insurance (also sometimes called “Casualty insurance”) that covers the liability to provide compensation to another party when the insured is at fault (negligent acts) or where compensation is required by law

- Liability insurance can include liability for damage to property and injury to persons, an example is Workers Compensation

- See this

explanation in the US context

Main classes of general insurance business #

- Motor Insurance:

- Compulsory Third Party (CTP) insurance

- CTP is designed to provide cover for liability for bodily injury or death as a result of an accident.

- CTP is administered differently across the different Australian states.

- Third Party Property Damage cover: protects the policyholder from the costs of damage your car causes to someone else’s car or property.

- Third Party Fire and Theft cover: this has all benefits from the Third Party Property Damage cover, as well as protection to your car against fire and theft.

- Comprehensive insurance cover: cover your car against damage caused by a number of events including theft, accidents (including “at fault”), flood, storm, fire, earthquake, as well as the benefits from the Third Party Property Damage cover.

- Compulsory Third Party (CTP) insurance

- Building and Contents Insurance

- Household contents insurance: this protects a policyholder from damage to personal possessions, and burglary. Essentially, goods are replaced by the insurance company.

- Buildings insurance: this protects a policyholder from damage to a home/factory/office by an event such as a fire. Such an insurance policy would normally pay for rebuilding or repairing the property.

-

Publicand Products Liability - Workers Compensation

- Private Health Insurance

- Emerging: related to sharing economy (Uber, AirBnB, ) as well as cyber risk.

See also thisSwissRe study,

AXA, … and thearticles on cyber risk in Actuaries Digital

Main features of general insurance products #

Main characteristics #

- Shorter coverage periods than for life insurance contracts - usually one year coverage policies

- Longer settlement: payment of claims can extend over many years into the future for long tail classes such as liability or workers compensation (as opposed to short-tail classes such as motor and home). But how long is a very long settlement period? See this

- Random frequencies and severities: Insured can claim more than once - amount of a claim is variable, and high variability of claims

- No (or very high) upper bounds for outcomes: Risk of large claims arising from one event such as a cyclone, fire or earthquake

Particular challenges:

- modelling of catastrophe risk (“modelled” risks, rather than fitted to past data)

- Controlling for moral hazard and fraud

- Presence of experience rating: bonus/malus, no claim discounts, …

- Presence of excess / deductibles

- reduction of moral hazard

- reduction of administrative costs

- insured have a choice of how much risk to retain/transfer

Contrast with life insurance #

Life insurance:

- Usually long term cover

- Frequency is binary

(0 or 1) - Severity is usually fixed or deterministic

- No moral hazard and no small claims so usually no excess (murder is an exclusion)

- Level premiums are usually paid over several years

- Renewal guaranteed

- Core difficulties investment of premiums over long periods of time, and longevity risk

General insurance:

- Usually short term cover

- Frequency is more complex

(0, 1, 2, …) - Severity is typically random (and different for each claim)

- Excess due to significant moral hazard and potentially small claims

- Single premiums, which can vary on renewal

- No guarantee of renewal

- Core difficulty is estimation of existing, outstanding liabilities (IBNR, RBNS)

Role of the actuary in general insurance #

Modelling of risks #

- Understanding risks and their interactions is of paramount importance.

- This typically goes through modelling of frequency and severity separately; for instance, for a particular risk, one might assume:

- data for the past

\(k\)years include claim counts, say,\(n_1, n_2, \ldots,n_j, \ldots, n_k\), from which we can estimate the distribution of the claim frequency (say\(N\)) - data for the past years include claim severities, say,

\(x_1, x_2, \ldots, x_{n_j}\)($j=1,\ldots,k$), from which we can estimate the distribution of the claim severity. (say\(X_i\)) - Then the aggregate amount of claim from this risk is modelled as

$$S=\sum_{i=1}^N X_i,$$where\(N\)is the claim frequency,\(X_1, X_2, \ldots\)are claim severities. This is what we call a random sum.

- data for the past

- Dependencies between classes of business, between insurance and other risks (such as investment risk), as well as between severity and frequency, are all potentially material and need to be considered.

Pricing #

-

Just as in life insurance, one must understand what the main drivers of risk are, and when someone seeks coverage, an assessment of their level of risk will be carried out (underwriting)

-

The actuary will typically analyse data in order to determine statistically significant rating factors

-

Once a risk is classified into a group, the gross premium for

\(S\), the aggregate claim amount from this risk is given as follow:- Gross premium = pure premium + risk loading + expenses + profit loading - investment income.

It is usually at the “pure premium” level that relativities are applied, to reflect different levels of risk.

-

How to adjust premiums of future years based on past claim experience (the so-called “experience rating”) is also part of the actuary’s responsibilities.

Reserving #

- Determining the amount of reserves is one of the most important jobs of the general insurance actuary.

- Reserves are of the utmost importance: they typically represent a significant proportion of the balance sheet of insurers:

- 1% variation may represent tens of millions of $.

- Reserves are usually a multiple of Equity (e.g., 2-5 times equity)

- Reserving involves a significant amount of past data analysis, and trying to infer

- how many insured events occurred (even though not all of them may be reported)

\(\leftarrow\)IBNR (“incurred But Not Reported”) - and for those that are known, predicting how much they might eventually cost.

\(\leftarrow\)RBNS (“Reported But Not Settled”)

- how many insured events occurred (even though not all of them may be reported)

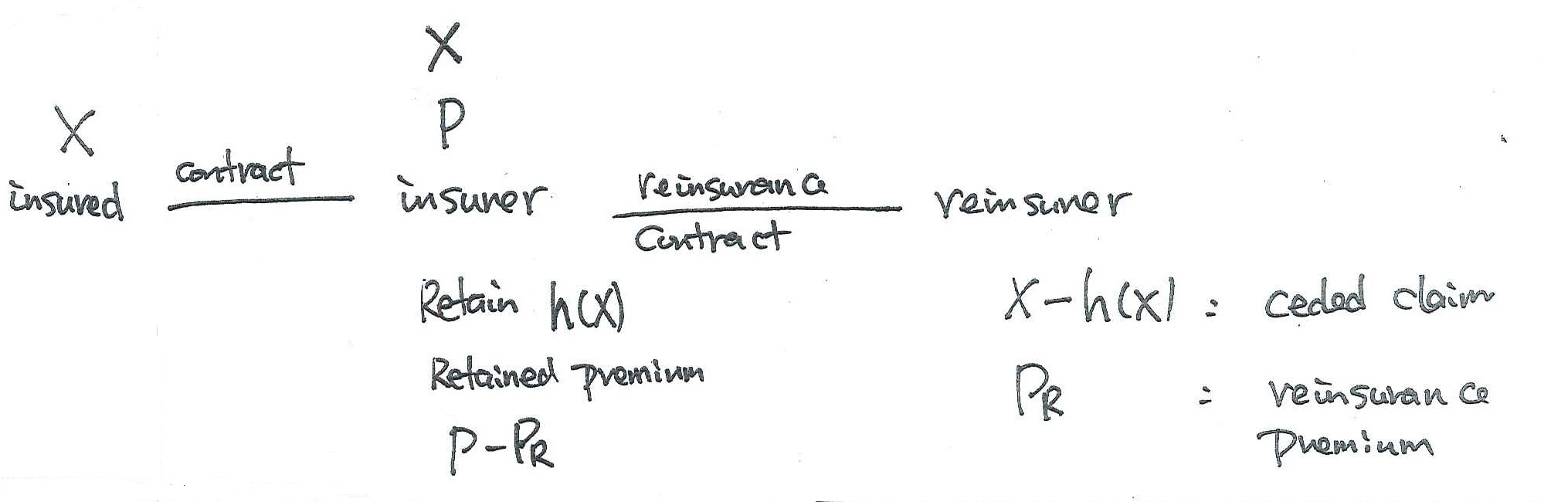

Reinsurance #

Definition #

In simple terms, a reinsurance company acts as an insurer to an insurance company.

Two commonly used types of reinsurance arrangements #

Proportional reinsurance: for each claim of amount \(X\), where \(0<a<1\):

- the retained claim amount by the insurer is

$$h(X)=a X,$$ - and the ceded amount to the reinsurer is

$$X-h(X)=(1-a)X.$$

Stop loss reinsurance: for each claim of amount \(X\),

- the retained claim amount by the insurer is

$$h(x) = \min(X, M),$$ - and the ceded claim amount to the reinsurer is

$$X-h(x) = \max(0, X-M).$$

The choice of reinsurance level #

- The appointed actuary (AA) of a general insurance company typically advises the Board when it determines its risk appetite, and then helps the company achieve its desired level of risk. This involves:

- assessing what type of reinsurance might be appropriate

- assess the cost of purchasing such reinsurance

- assess the impact of reinsurance on the risk level of the insurance company in view of its risk appetite

- Of course, the pricing actuary of a reinsurer will be naturally pricing reinsurance covers.

- Optimal reinsurance design is a research field in itself. When making simple (even simplistic) assumptions, some conclusions can be drawn.

- For instance, Tutorial Question

TQ-generalinsurance-4shows how one could think that stop loss is optimal for the direct insurer, whereas proportional reinsurance might be better for the reinsurer. Really, the question there is who covers the tail…

- For instance, Tutorial Question

The actuarial expert corner #

Interview: Luke Cassar #

Luke Cassar FIAA

Senior Consultant at Finity Consulting

Luke Cassar: take-aways #

1:01 (actuaries and general insurance)

- bread and butter: “appointed actuary” role: (i) insurance liability valuation, (ii) financial condition report

- also: workers compensation schemes (also liabilities), advice on pricing (including marketing strategy), capital modelling (including DFA), reinsurance strategy, CTP, liability practice area (modelling of risk)

4:26 (who hires GI actuaries)

- insurance companies (‘corporates’): big ones such as IAG, QBE, Suncorp; but also boutique ones

- consulting companies: actuarial arm in big consultants, or boutique actuarial

- government agencies: state workers compensation, self insurance schemes, NDIA

6:11 (what’s great about GI)

- digital disruption: both types of products AND the way insurance operates

- e.g.: driverless cars, shared economy (Uber, Airbnb)

- other issues are product focussed: CTP in NSW, NDIS, climate change and property insurance

10:16 (advice)

- studies provides tool kit

- spend time on AI website + Actuaries Digital magazine

- keep in touch with people in the industry (what is happening?, what is their company like?)

- keep an open mind, and expose yourself to as many different issues as possible

- don’t specialise too early

Industry insights #

(still) Emerging area: cyber risk #

AD: What’s covered in a cyber insurance policy?

AD: Insuring Cyber Risk in 2020

- Two types of coverage

- First Party: incident response, business interruption, data restauration, cyber extortion, etc…

- Third Party: privacy and confidential liability, network liability (network infected from your computer), media liability (copyright)

- Cyber insurance market is 5 years old, with now approximatively $130 mio or annual premium (tiny! - total premiums is about $6 bio) across more than 25 insurers.

- Some trends:

- standardisation of coverage

- market growth (to smaller businesses)

- increase in claims frequency (first party ransomware), but data is limited

- combined ratio is approximately 75% in Australia

- gets into governance (appointment of CISO - Chief Information Security Officer, Board involvement)

- Covid-19 led to a five-fold increase of cyber attacks (phishing, vulnerability due to WFH)

- Suggests 12 elements (relativities) to be considered in the underwriting process – but typically only 3 are being used

- This risk is global, which makes it special

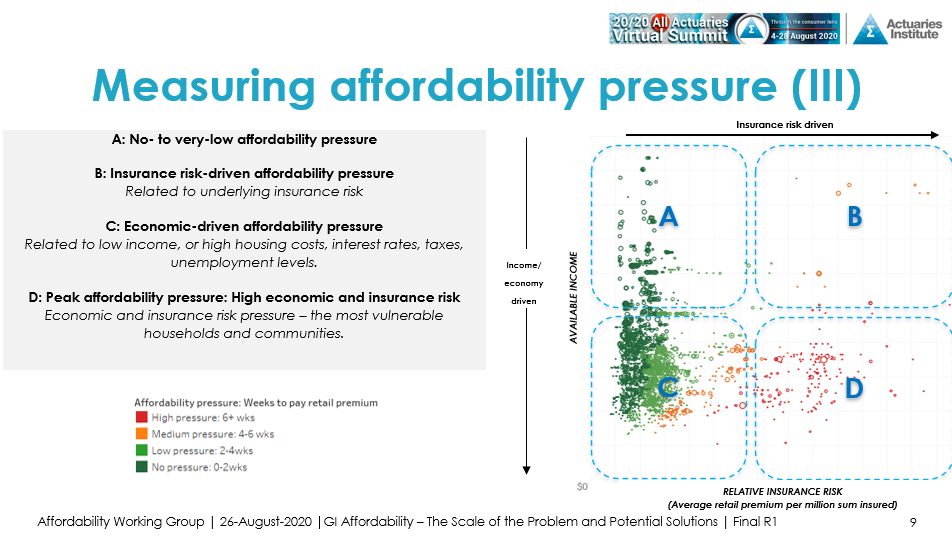

Insurance affordability #

AD: Insurance Affordability in Northern Queensland

- “General Insurance Affordability Working Group”: looked at the measurement and scale of the affordability problem, as well as possible solutions

- What is “insurance affordibility?” How do you measure it?

- Option 1:

- “Housing Affordability Pressure metric” (essentially net disposable income after housing costs using ABS data) vs

- “Relative Insurance Risk metric”(retail premiums per sum insured)

- Option 2: average number of weeks needed to pay for the annual cost of home insurance

Metrics:

Possible solutions:

- mitigation is key, but risk can’t be eliminated - who picks up the tab?

- non-pool options:

- community rating

- reduce non-risk costs (taxes, brokerage, …)

- government subsidies

- pool options

- spread losses across space (including overseas) and time (across generations) to smooth out fluctuations

- reinsurance pool vs insurance pool (where government acts as a direct insurer)

- any solution will involve spreading losses across time and space

The article also discusses the decision making process, without lobbying one way or another.

AD: Virtual Summit Shorts: A grand proposal for uninsurable risks

- how can we make the risk more insurable (less risky)?

- some coverage is better than none - why take an all or nothing approach?

- idea: share the tail

IBM: Insurers welcome government reinsurance pool for cyclone and flood risk

- Final solution:

- 10 billion reinsurance pool for cyclone and cyclone-related flood risk in northern Australia (the spreading of risk bit)

- 40 million investment in making older strata buildings more resilient (the mitigation bit)

- Insurers had set up a “Reinsurance Pool Working Group” which led to the solution.

What about COVID-19? #

- Business Interruption (BI):

AD: Business interruption in a COVID-19 Australia- importance of wording

- was the pandemic an exclusion or not?

- what will happen in the future?

- Workers Compensation:

IN: Workers' comp claims set to rise as economy reopens: Finity- “Workers’ compensation claims are likely to increase when the economy opens up, as states and territories transition to “living with COVID-19,” actuarial firm Finity has warned in a new report”

- “The big question is, how many of those infections are actually going to be compensable under a workers’ compensation policy.”

- But also travel insurance, and others…

General Insurance Practice Committee #

General Insurance Practice Committee (GIPC) website

(non mandatory)

References #

Atkinson, M. E., and David C. M. Dickson. 2011. An Introduction to Actuarial Studies. 2nd ed. Edward Elgar.