Context: ageing society #

- Reduced mortality - people live longer, including need for long term care

\(\longrightarrow\)longevity risk - Improved medical research - people need health benefits for longer, and which get more expensive at a higher rate than CPI or GDP growth

- Lower fertility rates

- Fewer younger people paying taxes to support growing proportion of older people

- Higher dependency ratio

This leads to increasing costs - and increasing taxation.

Pay-as-you-go (PAYG) vs funded systems #

PAYG: benefits of year \(N\) are funded by contributions of year \(N\)

Funded systems: benefits of year \(N\) (and potentially \(N+1, N+2, \dots\)) are funded by accumulated capital over the years \(1, \ldots, N-1\).

- Usually, PAYG systems are set up at the country level. Funded systems are usually individual.

- PAYG systems are good for immediate benefits (introduction of a new scheme), and they are more resilient to big affordability shocks (crisis, inflation, etc…) (contributions would be made on the same basis are required benefits). However, you may be at a risk of contributing for many years, then get nothing.

- Funded systems are better in that they do not rely on the promise of someone else paying the benefit later (the money is there), but they are more sensitive to market shocks (the money is invested, so if investments do not perform then the money may disappear

altogether, leaving you with nothing)

-

A combination of both is usually best, and is the solution in many developed countries. Often, systems have three pillars:

- A first pillar corresponding to a safety net, universal, PAYG

- A second pillar complementing the first pillar, often mandatory for salary earning workforce, funded, with tax breaks

- A third pillar that is voluntary, funded, with or without tax breaks

The mix changes from one country to another, and may be more or less sustainable.

-

To assess the sustainability of such systems is the job of some actuaries. How is Australia doing?

The Australian system: Three pillars #

- 1st pillar: Government provided pension

- means tested (assets and income)

- benefits are small

- 2nd pillar: Superannuation Guarantee.

- Minimum is 10% (used to be 9%, will continue to

increase to 12% by 2025). Can be more (e.g. Australian academics (to Unisuper) 17% from employer + up to 7% from employee). - Incentives include tax breaks: Contributions taxed at flat 15% (with limits). Benefits generally not taxed.

- Minimum is 10% (used to be 9%, will continue to

- 3rd pillar: Private savings (voluntary)

- Major asset class in Australia is real estate (due to a variety of reasons, including tax rules related to the above), which presents issues (lack of diversification, lack of liquidity, housing unaffordability). Own home does not attract capital gains tax.

Employer Sponsored Superannuation Funds #

The accumulation and decumulation phases #

- Typically, superannuation funds (also called “occupational pension funds” internationally) are funded systems which are typically based on individuals

- They belong to Pillar II

- This means the lifecycle of membership includes two major phases:

- The Accumulation Phase: when contributions are aggregated and invested, typically during the active years of the member

- The Decumulation Phase: when funds are being drawn to fund the members’s expenses, typically during retirement.

The accumulation phase #

- Members typically join a fund when they start employment and pay contributions to the fund whilst in employment. Employers usually contribute to the fund too.

- Unlike life insurance premiums, contributions are not usually level, but depend on a member’s salary.

- The contributions are invested, so that the main income to a superannuation fund is from contributions and investment income.

The decumulation phase #

- Outgo from a superannuation fund is in the form of benefits.

- Benefits can be payable under a variety of circumstances, including:

- retirement, due to reaching a certain age, e.g. 60 or 65

- retirement, due to failing health

- death, whilst still in the accumulation phase

- resignation from employment, which may cause a member to leave the superannuation fund (with their balance or not)

DC vs DB funds #

There are two main types of superannuation funds:

- Defined Contribution (DC)

- Defined Benefit (DB)

Note:

- In Australia, DC is the dominant form, but this is not true everywhere

- Not all funds are purely DC or DB, as some may include DC and DB components

- This distinction is mostly about the accumulation phase in case of lumps sum benefits, but in DB plans benefits can also be formulated as a life annuity (pension)

Defined Contribution (DC) Funds #

Main principles:

- A Defined Contribution fund acts like a bank account, with a variable rate of return on a member’s contributions.

- This rate of return depends on the investment performance of the fund (usually depends on investment choices made by the member)

- The final retirement benefit is the total balance of a member’s Super account (minus fees and taxes) and is dependent on investment performance.

Advantages:

- It is relatively transparent / understandable – most people understand the concept of a bank account

- Members have some control over their investments (they typically choose a strategy, not the actual investments)

- The fund won’t be forced to adjust contributions, although changes can always be possible if everyone agrees

Disadvantages:

- An important drawback about DC super is that the investment risk is borne by the member. Furthermore, it pre-supposes that members know how to make choices about their investments, which is a strong assumption

What is the typical role of actuaries in DC funds?

- For the accumulation phase, not much, although actuaries may be involved in advising on investments.

- For the decumulation phase, no more no less than with a DB fund. It really depends on how benefits are organised.

Defined Benefit (DB) Funds #

Main principles:

- In a Defined Benefit plan, the retirement benefit is calculated according to a deterministic formula (rather than by random investment returns)

- The fund is responsible for collecting sufficient contributions so as to fund those benefits.

- In other words: benefits are not defined by the contributions, but are defined in the rules of the plan itself (hence the “defined benefit” denomination)

For example:

- In a given DB fund, the formula for calculating the annual amount of the annuity benefit is

$$\frac{n}{60}\times \text{ Final average salary} $$

where

\(n\)denotes years of service. - In another fund, the lump sum benefit on retirement is the product of the following

- Final average salary

- Number of years of service

- Lump sum factor (depends on the age of retirement)

- Average salary fraction (employment %age)

- Average contribution factor (depends on how much extra contributions the member paid)

Advantages:

- Benefits are deterministically calculated, based on some factors (e.g., final salary). It is easier for members to understand (and predict) how much they will receive.

- Related to the above, the investment fluctuations do not affect benefits. This means that most of the investment risk is borne by the fund. Of course, if things go really wrong some measures may need to be taken, but this should only be in extreme cases.

Disadvantages:

- No exposure to the downside investment risk means that there is also less exposure to the upside investment risk: the fund will set aside above-than-average returns for the difficult years, rather than distribute them immediately to members

- Since benefits are fixed, contributions may have to be adjusted if assumptions change (e.g. investment returns, longevity, mortality, …)

What is the typical role of actuaries in DB funds?

- Because the timing of benefits doesn’t match necessarily that of investments (contrary to DC funds), careful modelling is required. Actuaries can help (remember the “Wealth Management” practice area)

- Actuaries have an essential role in valuing the funds’ liabilities, and setting contribution rates:

- Funds undergo regular valuations, the main purpose of which is to determine whether the fund’s liabilities can be met by existing assets and future contributions

- The valuation is also used to determine the contribution rate; mostly it assesses whether the current contribution rate is adequate. This involves building models for population entry (new employees, transfers), exit (resignations, retirements, death and disability), and other major assumptions (interest rates, salary of members, family situation, health status, …)

- Valuations can occur at the individual level, too. When a member leaves before retirement, the value of his acquired rights needs to be valued so that they can leave with their savings.

This may involve complex modelling.

The actuarial expert corner #

Interview: Anthony Saliba #

Anthony Saliba FIAA

Then: Senior Actuary Superannuation & Investments at CommInsure

Now: Director, Deloitte (FinTech and Retirement Income)

Anthony Saliba: take-aways #

0:00 (Intro)

- moved from a banking and capital markets team to superannuation! All those fields are interconnected.

2:06 (Actuaries in Superannuation)

- beyond traditional life insurance: asset liability modelling, modelling of customer outcomes

- in particular, retirement income strategies

- policy risk (what if policy changes, what is the impact?)

- financial advice

2:51 (Current and Future Challenges)

- Accumulation quite mature, but how do we keep up income on those balances?

- Main focus now is on decumulation: how do you turn the accumulated sump sum into retirement income?

- This is difficult:

- No benchmark

- Longevity risk, Investment risk, Health risk, Policy risk

- I would add: Circumstances and plans change from one individual to another, too. For instance,

- family (do kids want money for their home deposit?),

- risk aversion (investment safety vs higher return),

- plans (e.g. do you want to travel a lot?),

- housing needs (do you have a house? do you want to downsize? move elsewhere? …)

9:48 (advice):

- broaden skill set

- actuarial studies is a great place to start

- don’t specialise too soon

- opportunity: nexus pure actuarial and IT

Industry insights #

AD: “Investing for the Different Phases of Retirement” #

Investing for Different Phases of Retirement - Written by Michael Rice (Actuary of the Year 2017)

“Matching strategies, products and advice to the specific demands of an ageing population is one of the greatest challenges facing the retirement sector in Australia today.”

" \([\ldots]\) encouraged funds to begin looking at better segmentation of their members along with revised investment strategies which utilise separate “buckets” of funds to meet different financial needs in retirement rather than one generic approach."

Phases of retirement:

- active phase

- sedentary phase (perhaps 75/80+) – everything slows down (including expenditure)

- frail phase (85+) – mind and body decline

AD: “What is an investment-linked annuity?” #

What is an investment-linked annuity?

- An investment-linked lifetime annuity provides “longevity protection to ensure the retiree never runs out of money but can also offer a choice of investments used to support that income.”

- “The main problem with allocating 100% of your superannuation to an Accounts Based Pension in retirement is you don’t know how long you are going to live. This means you don’t know how much income you can safely draw from your ABP each year.”

\(\longrightarrow\)longevity risk

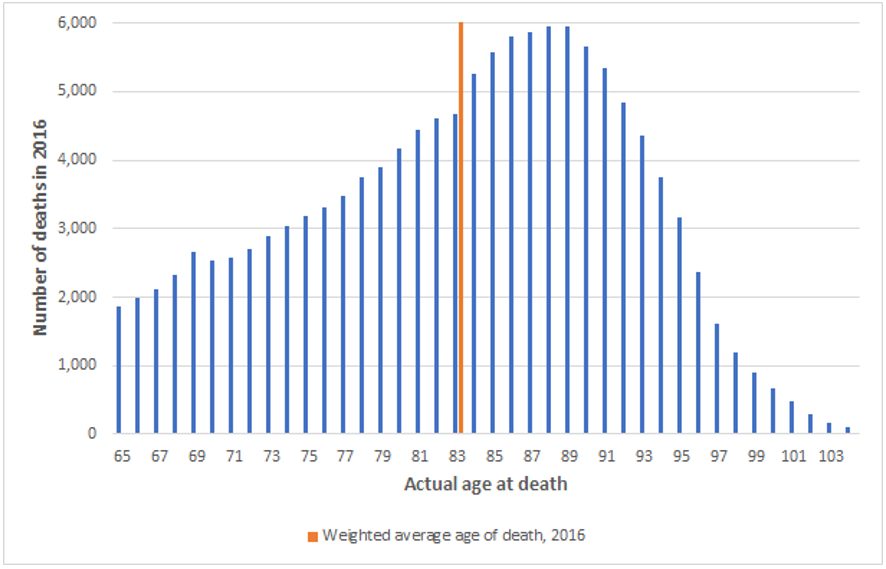

Actual age of death for all Australians who died during 2016 aged 65 or more:

Superannuation Practice Committee #

Latest update (non mandatory reference):