Valuing annuities #

Finding the present value of a series of equal payments

- So far we have considered the calculation of the present value and the accumulated value of single cash flows.

- It is quite common in practice for the same cash flows to be repeated

many times. For example,

- a new home owner may repay the bank $500 every fortnight over a 25 year period

- or a life insurance company might pay a retiree $1,500 every month for the rest of the person’s life.

- In order to value (that is, to find the present value of) a series of payments, we could find the present value of each individual payment in the series of payments and sum the resulting series.

- This approach will very quickly become tedious for long series of cash flows. We therefore develop formulae for finding the present value of streams of equal payments.

Annuity in arrears – Annuity-Immediate #

Definition #

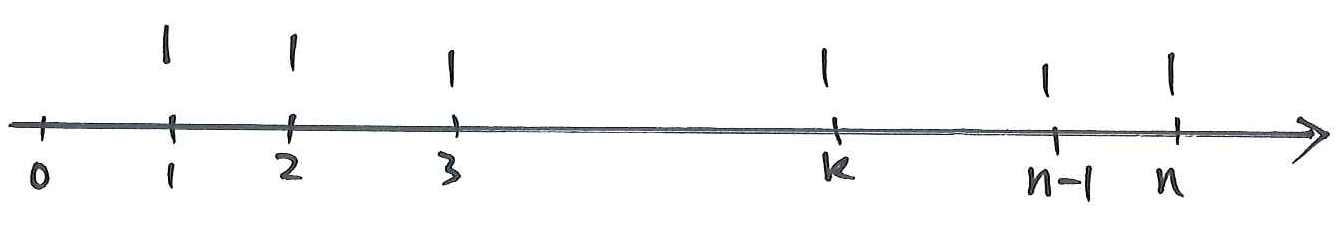

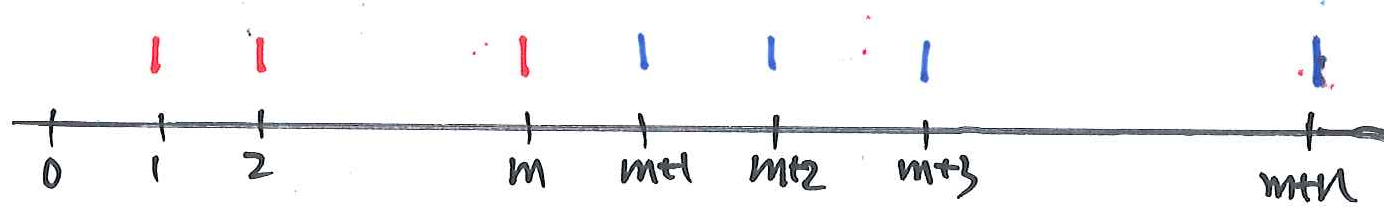

Consider the figure below which contains

We perform this calculation very often and so we give a symbol for

the present value result. Define

the payments are made at the end of each year.

Example 1 #

- Write down an expression in terms

- Use part (1) and the definition of

- If we rearrange our result from (2), we get

Solution to Part 1 #

We have

Solution to Part 2 #

Subtract the definition from the result in (1) to get

Solution to Part 3 #

We need to interpret

The present value of the borrowings ($1) must equal the present value of the interest repayments

Part 3: A concrete example #

- Take

- Suppose I lend you $100 and charge you interest at 5% per annum effective. This means your debt in one year’s time will be $105.

- Suppose you repay $5 at the end of 1 year – you have repaid the interest only, and still owe me $100.

- At the end of the second year you again repay $5 – your debt is still $100.

- Suppose this pattern continues for 10 years – each year you pay $5 at the year end, and at the end of the 10th year you repay the $100.

- Your repayments can be represented as a 10 year annuity in arrears of amount 5, and a payment of 100 at time 10 years.

- As my loan has been repaid, the present value of my outgo equals that of my income, i.e.

Part 2: Alternative derivation #

How else could you derive the result in (2)?

By using the sum of a geometric progression with

Annuity in advance – Annuity-Due #

Definition #

- The annuity we considered above is called an annuity in arrears since the

payments are made at the end of each of the

- Suppose instead that the payments are made at the start of each of

the

- The annuity is then called an annuity in advance, or annuity-due.

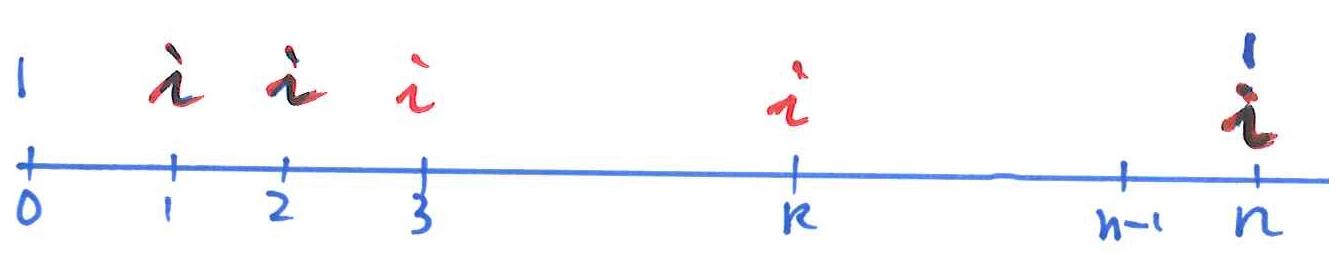

- Mark the payments and the valuation date on the diagram below for an

- The present value of an annuity in advance is written as

Example 2 #

- Write down a sum in terms of

- Explain in words why

- Show that

Solution to Part 1 #

We have

Solution to Part 2 #

The number of payments and the valuation interest rates are the same. The only difference is that payments occur one year earlier in

Solution to Part 3 #

Using our definition for

Example 3 #

- Find the PV of 20 annual payments of $1,000 at 6% per annum effective with the first payment due in 12 months’ time.

- Find the PV of 15 annual payments of $700 at 5% per annum effective with the first payment due immediately.

Solutions:

Some reasonableness checks for annuities #

Quite often in actuarial work, we are involved with very complex calculations. It is useful to be able to place a rough check (a reasonableness check) on our work at the end. This can be a useful way to remove any careless errors that we may have been made during the course of our work.

First check #

First, (assuming

Second check #

Second, (assuming

Third check #

Third, consider the amounts and the timing of the payments:

- Each of the

- The payment times are

For example, compare at 6%:

Example 4 #

- Calculate the PV of a series of payments of $100 at the end of each of the next 20 years at 9% per annum effective.

- Calculate the PV of a series of payments of $100 at the beginning of each of the next 15 years at 8% per annum convertible quarterly.

- Apply a reasonableness check to your answer to Part (2).

Solutions:

- The PV is

- The PV is

- The PV is approximately

Perpetuities #

Definition #

- In fact, this infinite term annuity seen before is called a perpetuity, and is written

- This can also be used as a building block to derive annuity formulas.

Example 5 #

Derive the formula for an annuity-immediate

Solution:

- Consider the difference between two infinite series of payment of 1, one starting now with present value

- The difference in cash flows corresponds exactly to that of an annuity-immediate over

Deferred annuities #

Definition #

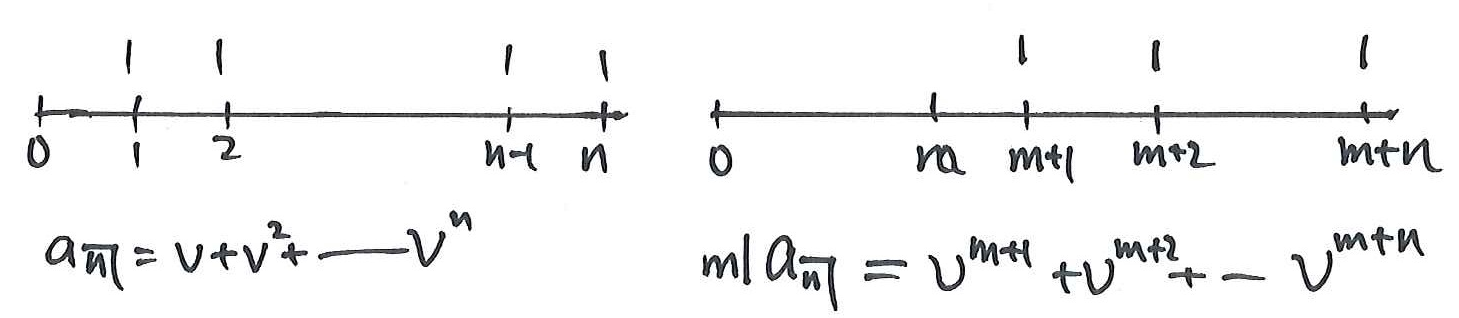

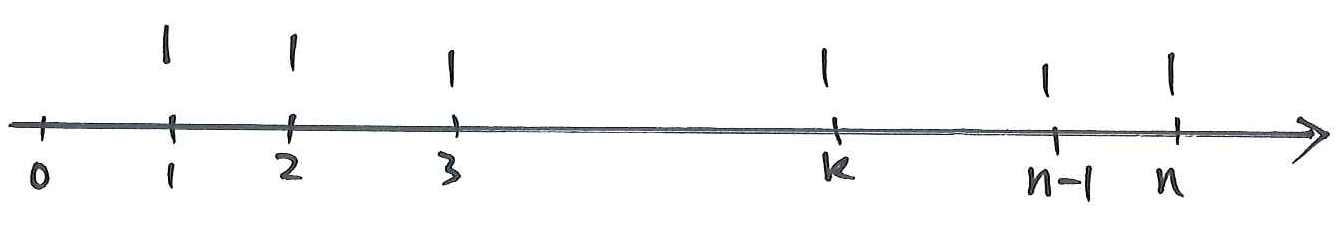

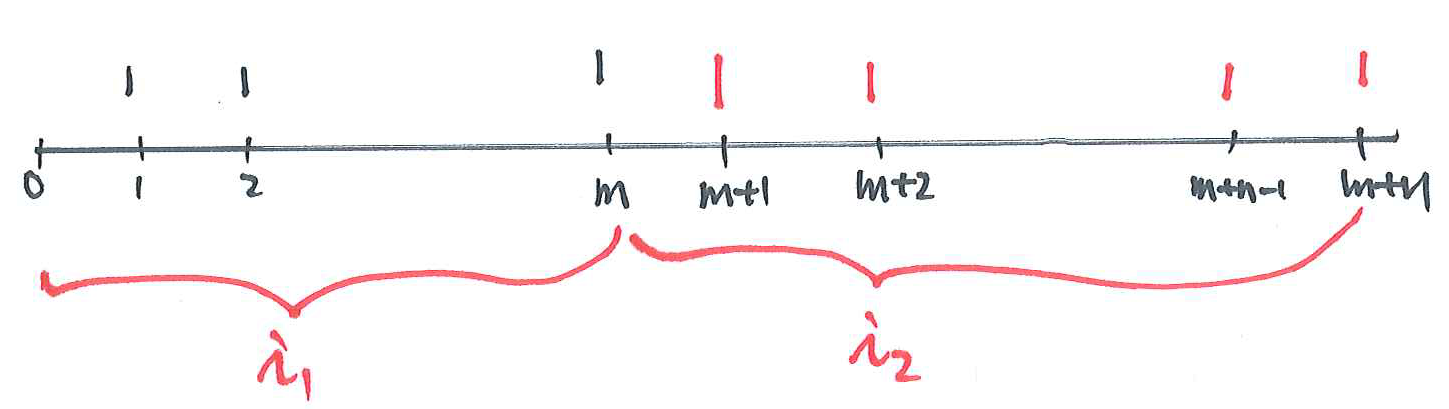

We now develop formulae for annuities where the first payment is delayed by

Consider first the annuity in arrears. In the non-deferred case, the first payment is made at the end of the first year, that is, at time 1. In the deferred annuity, the first payment is therefore made at time

The notation used for the present value of an

Example 6 #

- Write down an expression for

- Write an expression for

Solutions:

- From above, the expression for

Formula

Proof of

Using the result in part (2) of Example 6 above, we have

Interpretation #

Example 7 #

Find the PV of a series of 15 payments of $1 at yearly intervals beginning 11 years from now. Use an interest rate of 7% per annum effective.

- Method One: The PV is

- Method Two: The PV is

- Rough Check: PV

Annuities payable in

Annuities payable

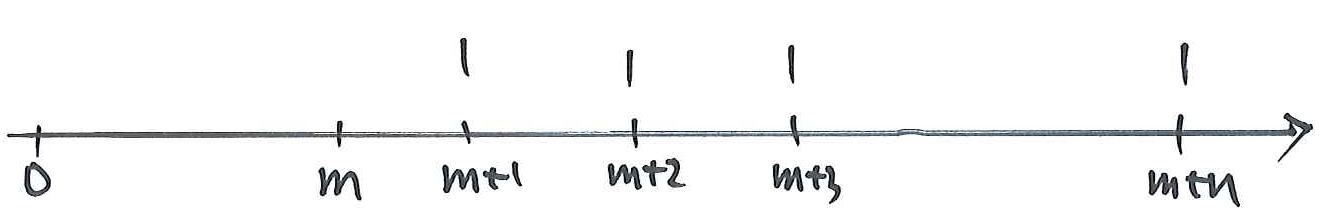

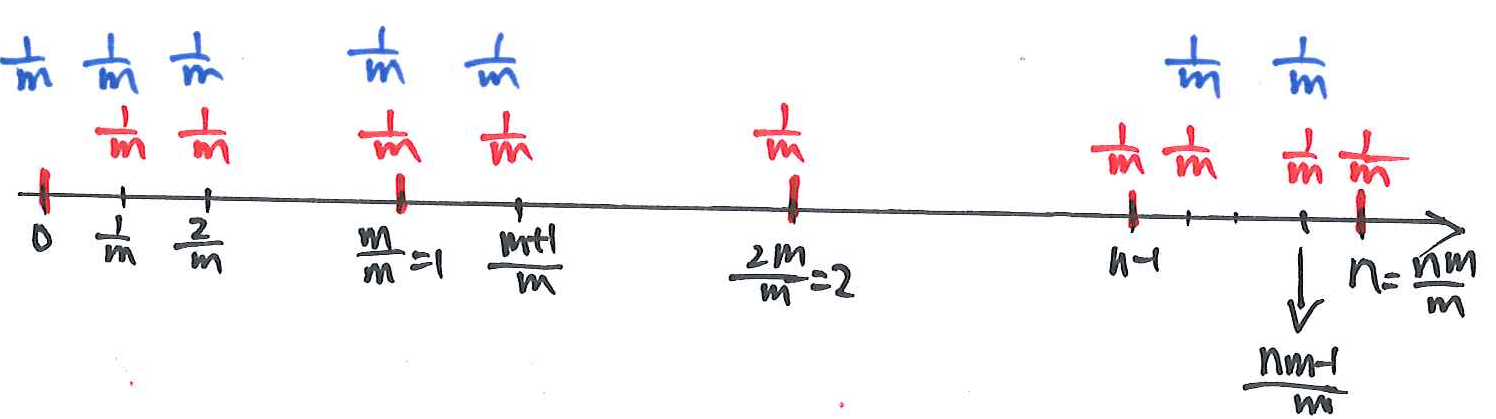

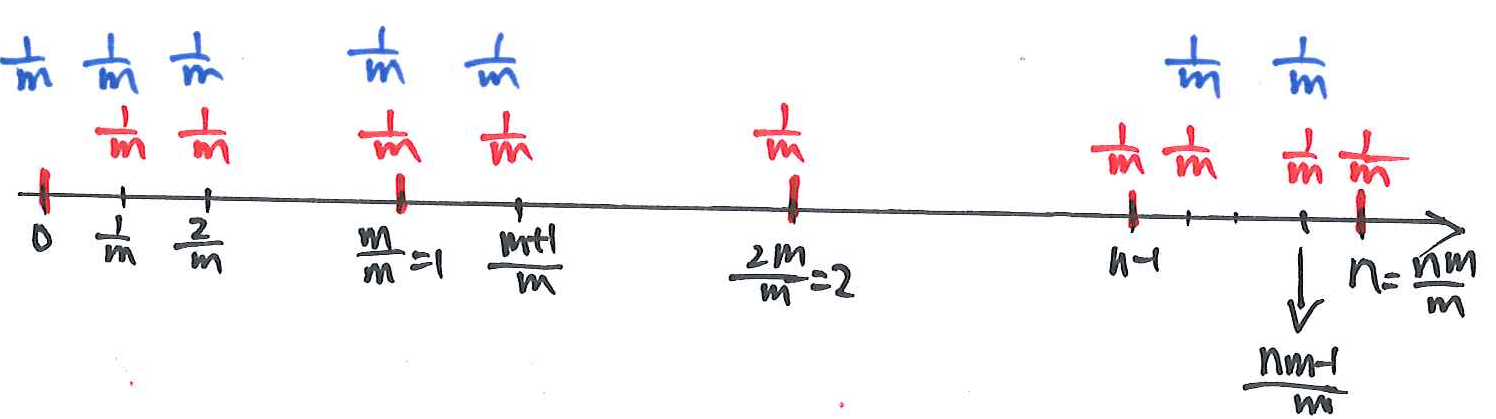

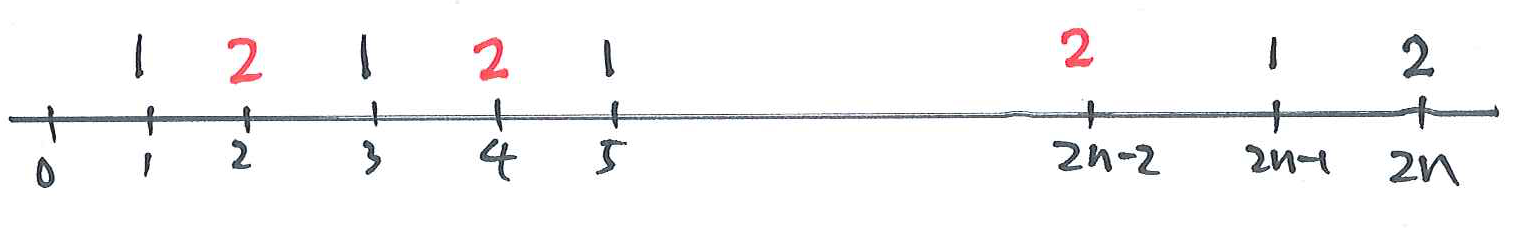

- We have already discussed annuities where payments are made for

- We now break up that single payment of $1 into

- Consider the following timeline and mark on the payments for a

The notation used for an

Subtracting the first identity from the second gives

$$a_{\angl{n}}^{(m)}\left( (1+i)^{1/m}-1\right) =\frac{1}{m}\left( 1-v^{nm/m}\right) $$ or, equivalently,

The notation used for an

Examples #

Example 8 #

Find the PV of $100 per annum payable quarterly in arrears for 10 years at 7.5% per annum effective.

Solution:

We have

Example 9 #

Find the PV of $100 per annum payable quarterly in arrears for 10 years given interest is 8% per annum convertible quarterly.

Solution:

Alternative derivations #

An alternative expression for

Changing the time unit,

In the above formula,

- The time unit is

An alternative expression for

By analogy, we have

Accumulated values of annuities #

Definition #

- Consider a superannuation fund into which payments are made during the working life of an individual. These payments will form a regular stream of payments and we are interested in knowing how much these payments will be worth at retirement, when interest is applied to each of the payments.

- We therefore are often interested in calculating the accumulated value of an annuity.

Accumulated value of an annuity in arrears #

We derive an expression for

Relationship between

We now derive a relationship between

Result:

Proof:

Accumulated values of an annuity-due #

Suppose now that the

We aim to find the value of these payments at time

Notation:

Examples #

Example 10 #

- Write down an expression in terms of

- Show that

Solutions:

Example 11 #

- Find the PV of a series of 10 payments of $100 at yearly intervals. The first payment is due in 3 months’ time. The interest rate is 8% per annum effective.

- From first principles, find the accumulated value of the series above at time 12 years.

- Check that your answers are consistent.

Solutions:

- The PV is

- The accumulated value is

- The valuation dates are 12 years apart. We can verify that

Further variations on annuities #

Annuities payable less frequently than once a year #

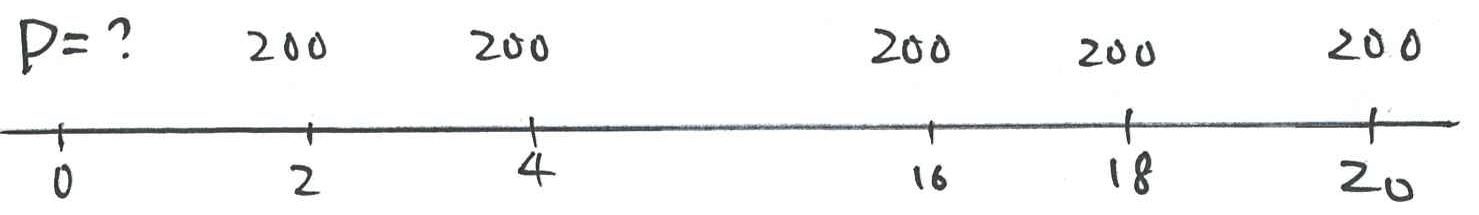

- Consider an annuity with regular payments of $200 payable at two yearly intervals in arrears.

- The final payment is made after 20 years.

- Find the PV at 6% per annum effective.

Method 1: Using First Principles

- Summing up the PVs of the individual payments, we get

Method 2: Change the time unit

- New time unit is two-year

- The effective 2-year interest rate is

- The 2-year discount factor is

Then the PV of this annuity is

Annuities with variable interest rate #

Consider the following

- If the effective annual interest rate is

- If the interest rate is

Annuities with variable payment amounts #

Consider the following annuity in arrears with term

Define

References #

Atkinson, M. E., and David C. M. Dickson. 2011. An Introduction to Actuarial Studies. 2nd ed. Edward Elgar.